Rystad Energy foresees the LNG crisis making landfall in winter 2022 for European countries dealing with energy insecurity due to Russia’s invasion of Ukraine.

Illustration only; Courtesy of Klaipedos Nafta

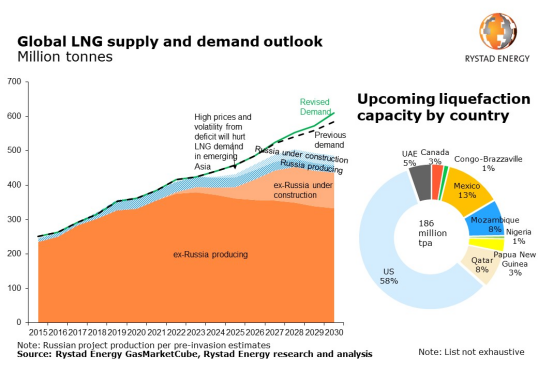

This will take place as demand outstrips supply by the end of 2022, Rystad Energy research shows. Although the crisis has spurred the greatest rush of new LNG projects in more than a decade, construction timelines mean they will bring relief only after 2024.

Global LNG demand is expected to hit 436 million tonnes in 2022, outpacing the available supply of just 410 million tonnes.

The EU’s REPowerEU plan set a target to reduce dependence on Russian gas by 66 per cent within this year; an aim that will clash with the EU’s goal of replenishing gas storage to 80 per cent of capacity by 1 November.

The decision to reduce reliance on Russian LNG from current levels of between 30 to 40 per cent will transform the global LNG market, Rystad says. This will result in a steep increase in energy-security-based European LNG demand that current projects will not be able to supply.

Last year, Russia sent 155 billion cubic meters (Bcm) of gas to Europe, providing more than 31 per cent of the region’s gas supply. Replacing a significant portion of this will be exceedingly difficult, with far-reaching consequences. These will also include the role of gas in the region’s energy transition.

“There simply is not enough LNG around to meet demand. In the short term, this will make for a hard winter in Europe. For producers, it suggests the next LNG boom is here, but it will arrive too late to meet the sharp spike in demand. The stage is set for a sustained supply deficit, high prices, extreme volatility, bullish markets, and heightened LNG geopolitics,” says Kaushal Ramesh, senior analyst for gas and LNG at Rystad.

Courtesy of Rystad Energy

The expected reduction in Russian gas for Europe in 2022 is 37 Bcm, rising to more than 100 Bcm by 2030. As a result, Europe’s gas consumption likely peaked in 2019 and will now decline steadily through to 2030.

Gas and LNG are therefore set to play a reduced role in Europe’s energy mix, providing further impetus for renewables and potentially a greater role for nuclear and coal.

Europe was on course to increase Russian imports of gas and LNG to over 40 per cent of its supply by 2030, if the Nord Stream 2 pipeline had been approved. This will instead drop to around 20 per cent by 2030 as current contracts are not renewed.

If Russian flows were to stop tomorrow, the gas currently in storage (about 35 per cent full) would likely run out before the end of the year. This would leave Europe exposed to a brutal winter. Under this scenario, in the absence of joint buying arrangements and countries competing for limited supply, the TTF gas price could climb to more than $100 MMBtu.

Recently, more than LNG 20 projects with a combined capacity of over 180 million tonnes per annum (mtpa) have reported some development progress. To ensure LNG supply in 2030, the market will need more than 150 mtpa of production from the 186 mtpa planned. This means that more than 80 per cent of the project pipeline must be realised.

U.S. projects are in pole position; some of which have been waiting for demand to rise now been given the opportunity. Projects such as Energy Transfer’s Lake Charles and NextDecade’s Rio Grande have reported 9.45 mtpa worth of deals after the invasion. This includes a deal by French player Engie, which pulled out of negotiations with NextDecade in November 2020 but recently closed a 1.75 mtpa deal with the same project.

However, according to Rystad all this remains far from able to rescue the market. It includes the 15 mtpa Rovuma Area 4 LNG project, to be located adjacent to TotalEnergies’ Area 1 LNG in the currently at-risk Palma region of Mozambique.

Mexico is also well-positioned for Asian exports due to geographical proximity and non-dependence on transit through the Panama Canal, and appears to be gaining momentum among Asian buyers. At the same time, higher prices will slow Asian LNG demand growth in the medium term. This means Asia will remain dependent on fuel oil and coal.

In some scenarios, Asian LNG demand may be permanently dented, and deployment of renewables accelerated.