The LNG industry can be divided into small, mid, and large scale projects, each with different value chains. New LNG production facilities, construction of new LNG terminals, and infrastructure development to deliver LNG by water, rail, and trucks enable LNG availability to consumers for transport, autonomous gasification, and autonomous heat and energy generation. Today, small scale LNG services (transhipment to containers, trucks, railway tanks, bunkering) are included in the service infrastructure at each new large scale LNG terminal. Thus, the LNG market’s small scale segment approaches perfect market conditions with numerous buyers and numerous sellers, i.e. LNG on LNG competition.

The Russian LNG production potential cannot be realised in full by building only large scale projects, and will have to rely on structural changes in the industry, including regulation:

The energy transition and global changes in energy carriers trigger changes in consumer preferences. As a result, the energy basket becomes more complex and resembles a mosaic – not only on the country level but also on smaller levels.

LNG is an energy carrier that meets both current and future requirements. Different production segments and market models evolve in the LNG market.

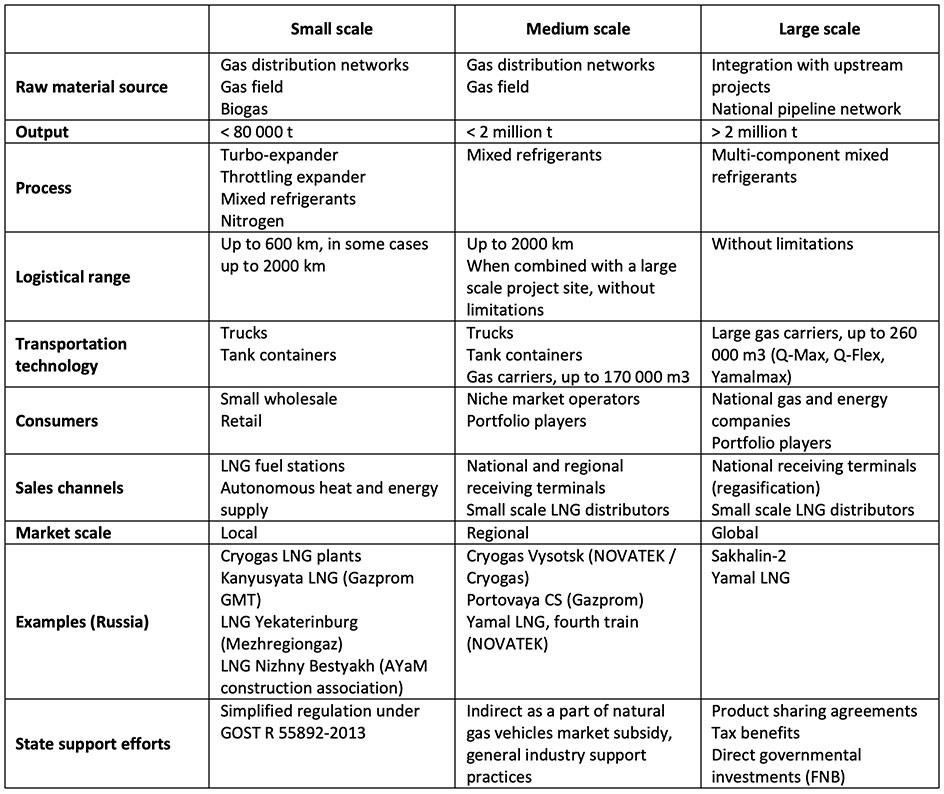

Table 2: Comparison of the small, medium, and large scale projects in Russia.

Unlike the majority of industrial technologies, LNG of equal quality can be produced at LNG plants of any size. Thus, LNG sales have no limitations and barriers in different geographical markets and market segments.

There are several global-level large scale LNG production facilities in Russia, but small and medium tonnage LNG production facilities are also actively developing. Amid the global increase in demand and supply, production chains are evolving on the market to make LNG available to as many consumers as possible.

Several LNG development regions with projects of different scale can be singled out in the Russian Federation:

Baltic wind

Upon completing the gas pipeline projects Nord Stream and Nord Stream 2, and by actively developing the Ust Luga port, Russia's Baltic shore will be appealing for implementing major gas processing projects.

Geographic proximity to European markets has triggered the development of an array of LNG projects in North-West Russia

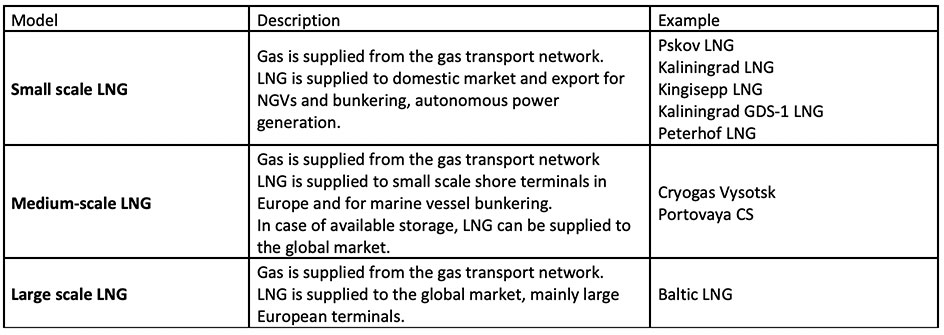

Table 3: LNG project development models in the Baltic Region

For several years already, LNG from Russian small scale plants has been supplied to Poland, Finland, and marine vessel bunkering. Since April 2019, the medium scale project in Vysotsk started production and delivered cargoes to Baltic countries, the Netherlands, and even Spain.

Gazprom’s LNG project in Ust Luga is in progress. The Baltic LNG + Baltic Gas Chemical Plant is the first example of a combined LNG production and natural gas separation. As gas chemical facilities are developed in Ust Luga, the Baltic shore will resemble the Gulf of Mexico's coastline, with its developed gas supply system and a large volume of gas available for liquefaction and production of different chemicals.

LNG output in this region will be 16.5 million t by 2024 under the declared projects. The Baltic is well-positioned to become a global centre of LNG production.

The explosive Russian LNG production growth in the Baltic region up to 2025 will necessitate significant changes throughout the value chain and significant changes in the Russian LNG industry legal regulation.

Arctic shore

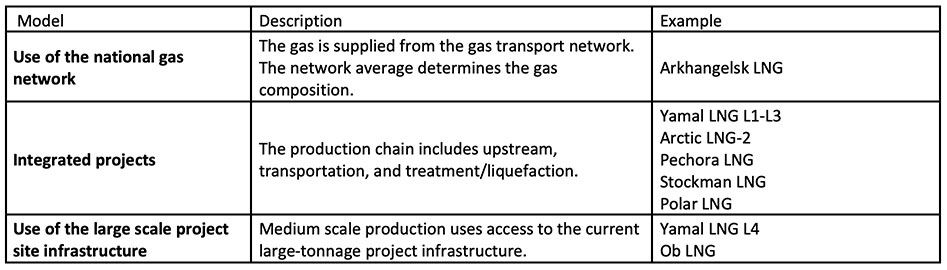

The Yamal LNG project has transformed the Russian Arctic into a global LNG production centre. LNG production in the Arctic ensures clean energy for the global economy and helps to decrease greenhouse gas (GHG) emissions. It will be quite logical to widely use LNG to fuel vessels, industrial projects, and the Russian Arctic settlements.

Despite global-scale LNG projects implemented in the Arctic, a diverse resource base is available for small and mid scale LNG production. Such projects are to grow in number as the infrastructure develops.

Table 4: Arctic LNG project development models.

Total LNG output in the Russian Arctic and the High North regions may exceed 80 million t by 2030, which creates prerequisites not only for export scaling up but for LNG use as bunker fuel in Arctic waters and supply to local consumers in the Arctic.

With the limited infrastructure and transport availability in the Arctic, the development of the following areas will be essential:

With the global IMO mediated processes intended to mitigate environmental risks when using bunker fuel in the Arctic, Russia may put forward a global initiative of banning the use of any oil products across the Arctic for the industry and transportation sector, 2035/2040 being the horizon for its implementation. To this end, Russia may act as a global gas fuel supplier for marine vessels, the industry, and road transport in the future.

Active growth in the Russian LNG production in the Arctic will require significant LNG transportation and storage infrastructure changes, new LNG processing, distribution solutions, and major changes in Russian LNG industry legal regulations.

(To be continued)