Wood Mackenzie’s latest report shows that over three quarters (77%) of new LNG supply are at risk under a 2°C scenario.

Under the scenario, gas demand comes under pressure from increased in-vestments in renewables and energy storage in the power sector, as well as efficiency improvements and adoption of new technologies in non-power sectors.

In a 2°C world, green hydrogen becomes a game changer in the long-term emerging as a key competitor to gas consumption towards the end of 2040 and achieving a 10% share in the total primary energy demand by 2050.

Wood Mackenzie principal analyst Kateryna Filippenko said: “With weaker global gas demand, the space for new developments will be limited. This is a significant challenge for companies considering FID on new projects.

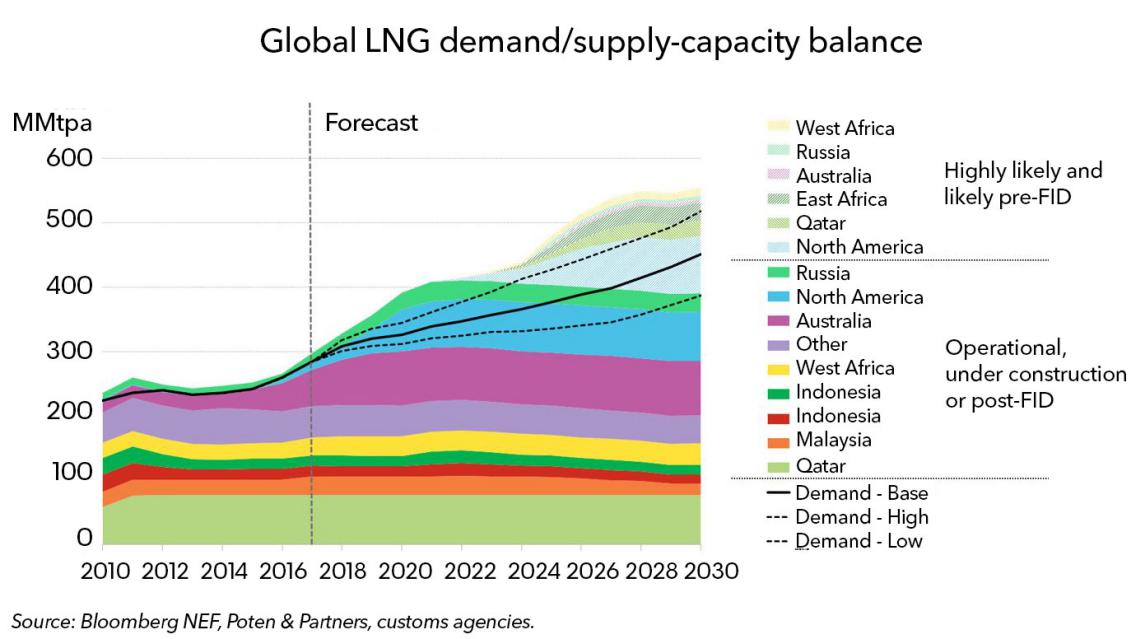

“In a 2°C world, only about 145 billion m3/y of additional LNG supply is needed in 2040 compared to 450 billion m3/y in our base case outlook. And if we consider imminent FID for Qatar North Field East expansion, the space for new projects shrinks to 104 billion m3/y, down 77% from our base case.”

Low-cost LNG suppliers Russia and Qatar are expected to be front-runners to fill the modest supply gap, while low Henry Hub prices would also mean competitive US LNG projects. But as Qatar and Russia pursue monetisation of their low-cost resource base, and LNG demand starts declining post 2035, the strategic rationale for others to invest becomes questionable.

Wood Mackenzie’s Global Gas Model suggests that in a 2°C scenario, only a few Australian backfill projects will go ahead, pushing the country down the list of top LNG exporters, while expansion of Canadian and Mozambique LNG capacities are unlikely to materialise. As LNG demand starts declining post 2035, US LNG underutilisation will be required to balance the market, similar to what has happened in 2020.

Wood Mackenzie research analyst Evgeniya Mezentseva said: “LNG developers will have a difficult decision to make. On the one hand, there will be windows of opportunities for investment decisions. But on the other hand, the long-term value of these investments might be at risk by the prospects of a shrinking market space combined with competitive pressure from low-er-cost producers.”

The category of projects most affected under a 2°C pathway are discovered pre-FID developments. In 2040, production from these projects are expected to be about 1300 billion m3 less compared to the base case outlook. Low prices could wipe out any new investment in more economically challenging projects, and only the most cost-efficient and flexible ones will survive.

Filippenko said: “Compared to our base case, the 2°C scenario will leave about 12 trillion m3 of discovered gas resources stranded. This is more than three times the amount of gas produced globally in 2020.

“Most of this will be in the US, Russia and the Middle East. These regions will face decreasing export opportunities for their vast gas resources in addition to lower domestic demand for gas.”